Infoblox already has a significant number of MSP partners, and their focus has been primarily on the enterprise, but the new consumption-based pricing option is much more attractive if they are also pushing downmarket into the midmarket and the SMB.

DNS-focused network control and security vendor Infoblox has announced a new program designed to provide its MSP partners with a consumption-based pricing model that many of them would prefer. The new pricing model is an option, not a new default system, as Infoblox expects that a minority of service providers will opt for the existing system. Infoblox sells two types of solutions a joint DDI [DNS, DHCP, and IP address management] offering, and a straight DNS-only security solution, and they expect that the new model will be especially popular among partners who sell the second, simpler, offering.

DNS-focused network control and security vendor Infoblox has announced a new program designed to provide its MSP partners with a consumption-based pricing model that many of them would prefer. The new pricing model is an option, not a new default system, as Infoblox expects that a minority of service providers will opt for the existing system. Infoblox sells two types of solutions a joint DDI [DNS, DHCP, and IP address management] offering, and a straight DNS-only security solution, and they expect that the new model will be especially popular among partners who sell the second, simpler, offering.

The new pricing model is an adjustment to an existing substantial presence among MSPs, not a tactic to establish a presence in that market.

“Today, we already serve managed service providers,” said Dilip Pillaipakam, vice president and general manager of Infoblox’s Service Provider Business. “Both MSPs and MSSPs are our customers today, and an important part of our Go-to-Market strategy. What we are doing with this new program is bolstering our support of these partners by offering them a pricing model that is more targeted to their business, and which is more MSP-friendly.”

Pillaipakam said that this was something that MSP partners had been asking them for.

“Most MSPs go to market sourcing products like this and putting together bundles of service offerings,” he said. “What this new model does is line up their commercial go-to-market with the commercial go-to-market they have with Infoblox. They sell on a consumption-based model. Typically, with vendors like us they pay us up front, so they asked us to line up the way we pay them with the way they do business with their customers. As a result, we have adjusted our commercial model so everything is in arrears. This also gives them the ability to have a truly flexible deployment model on the technical side as well. Because this is 100 per cent virtual systems-based, they could deploy a very large number of instances with nothing paid up front. It enables greater architectural flexibility.”

Pillaipakam stressed that this is a new pricing option, not a new default system, because some of the larger service providers are likely to stay with the current system.

“Even though much of the market is asking for this, it is not yet fully ready to absorb this model in some cases,” he indicated. “Some big Tier Ones pay for this on CAPEX. For them to change their back-end systems, as well as their compensation system will take time. We are not expecting all MSPs to go this model either, because some do capital allocation and budgeting the other way. This does, however, give them another option, so is another tool in our tool set.”

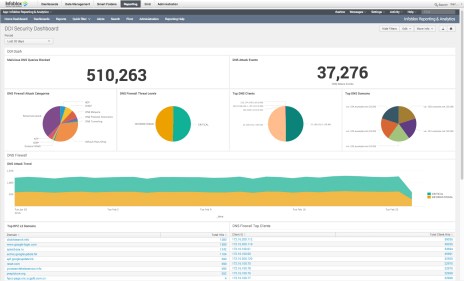

Infoblox started out as a pure network player in the DNS address management space, and later added a major security focus because the protection they offered to the DNS layer was not provided by security vendors. As a result, they have two different product sets, even in the security space.

“The DDI offering is a networking management one as well as security, providing managed LAN-WAN as part of the full suite of DNS/IP management,” Pillaipakam said. “It is aimed at the enterprise buyer. The other offering around managed security is just security without the network management, and addresses the fact that DNS has become a major attack vector, and customers are looking to fill that gap.”

The pure play security offering is much more attractive to the MSP market, and will be much more likely to be used in the new pricing model.

“Today, most of our MSP customers target the enterprise, but the flexibility of the new model, where they don’t have to put up the big up-front investment, will help them go downmarket,” Pillaipakam said. “The security offering is a much better fit downmarket, because there is downmarket demand for security from the midmarket and the SMB. That’s much less the case with the DDI. It’s a harder sell there, which requires more educating of most customers.”